The IA’s Framework looks to ride the current wave of climate ‘wokeness’. It proposes a common, industry-wide responsible investing language, offers clarity over the disclosure of sustainable indicators and promotes the idea of a ‘fund label’ to earmark funds with a Responsible Investing approach.

So far, so helpful. However, this is a sector with layer upon layer of so-called ‘initiatives’ and ‘frameworks’, all with apparently similar goals. And this is a space congested with government and intra-governmental organisations plying seemingly parallel responsible investing agendas. So, does the IA’s Framework have something new to offer or is it just more hot air?

The Investment Association’s Responsible Investment Framework

In an industry arguably guilty of greenwashing it is becoming increasingly important to establish a common, agreed language. The Framework aims to do just that by way of categorising different products at both firm and fund levels. It seeks to facilitate discussion of commonly used terms such as ‘ESG integration’, ‘stewardship’, ‘impact investing’, ‘exclusions’ and ‘sustainability focus’ (see Image 1 and Image 2 below).

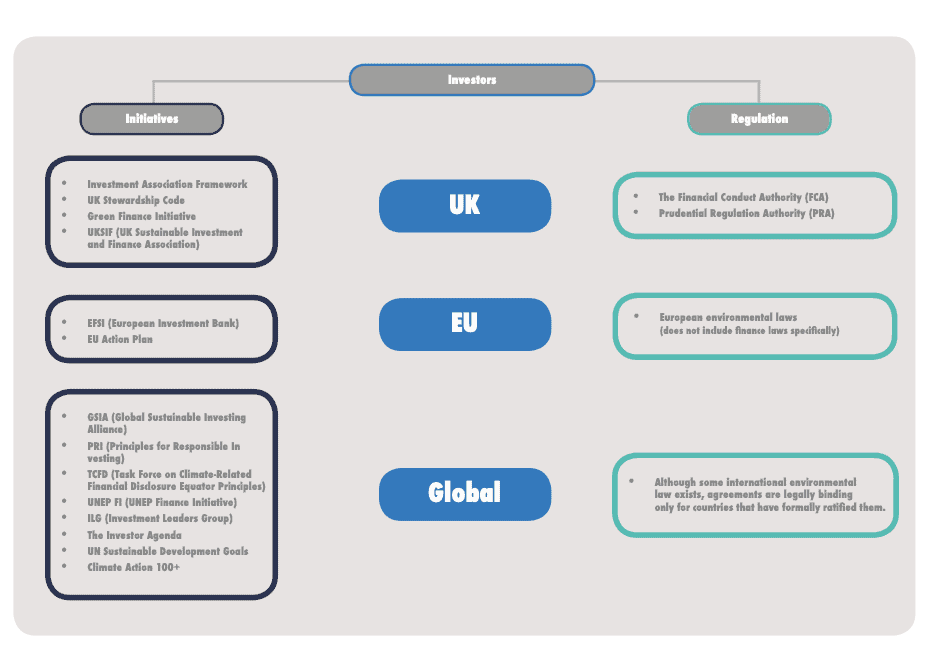

In isolation, this looks like a simple, straightforward guide for investors. However, in the context of Responsible Investment and sustainable finance in general, this ‘simple and straightforward’ guide sits amongst myriad organisations at different scales trying to achieve similar things. The IA’s Framework faces two fundamental challenges: the difference between initiatives and regulatory requirements, and the problem of scalability.

Initiative or regulatory requirement?

There are many bodies trying to implement positive change in the financial services industry, but they rarely carry legal clout. Even the United Nations’ Sustainable Development Goals (with 193 national signatories) legally binds no-one to anything.

Furthermore, the IA is a trade body that represents UK Investment Managers & Asset Management Firms. For Responsible Investment as a category, in addition to the IA, there are a plethora of additional voluntary initiatives to consider: the Principles for Responsible Investing (PRI), Climate Action 100+, the Task Force on Climate-Related Financial Disclosure (TCFD), the UK Stewardship Code, and the Investor Agenda – to name just a few.

Looking at the financial services industry more broadly though, there is a further set of voluntary initiatives for UK investors to consider: the Principles for Responsible Banking (PRB), the Principles for Sustainable Insurance (PSI), Equator Principles, Sustainable Stock Exchanges Initiative, United Nations Environment Programme Finance Initiative (UNEPFI), the Investment Leaders Group (ILG), the Global Sustainable Investment Alliance (GSIA) – again, naming just a few. And these are all just voluntary organisations for investors and financial companies to contemplate.

The Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) are the primary UK bodies responsible for enforcing laws which are set and reviewed by the Government on issues such as green finance. In June 2018, the House of Commons published its Green Finance Report aimed at embedding sustainability in financial decision making. The report requires that businesses and regulators factor long-term environmental risks into financial decision making. Unlike the IA’s ‘voluntary’ recommendations, the Green Finance Report carries regulatory weight.

Scalability

The issues, of course, extend beyond UK borders. The EU have been forced to regulate in responsible investing at a regional level owing to the divergent attitude of Member States on environmental issues. This makes life hard for an organisation like the IA because, although the Framework might be implemented by UK investors, many operate beyond the UK, suggesting that the IA’s Framework is superseded by a regional one. And then there are globally-focused organisations such as the previously mentioned TCFD and UNEPFI, as well as industry-focused organisations like the Sustainable Banking Network (SBN) and the PRI. No matter how clear and helpful the IA’s Framework, the organisation will face an uphill regional and global battle to get their voice heard in order to gain the international, industry-wide implementation they desire.

Looking ahead

Of course, these major challenges of voluntary adoption and scalability are not restricted to the IA. The numerous initiatives and organisations do a fantastic job in raising awareness of Responsible Investment within the financial services sector but ultimately, they lack the legislative authority of a regulator. Further, there is little cohesion between individual states, regional bodies (such as the EU) and global organisations (such as the UN) as to how to implement a standardised approach to environmentally sustainable finance. This will only restrict clarity and accountability for investors and regulators alike; the onus will remain on the investor to conclude that a particular investment is sustainable or not. The lack of an objective means of direct comparison between different investment opportunities will persist.

Fundamental to the Framework’s success going forward is whether the IA can gain the necessary support from the FS industry, government and regulators, as well as working out how to compete with regional and global voices on responsible investing.

Success in both of these areas seems a tall order but the prize – a common, industry-wide Responsible Investing language and improved clarity over the disclosure of sustainable indicators – is a prize worth fighting for.

By Thomas Farrell